07/07/2020

89%

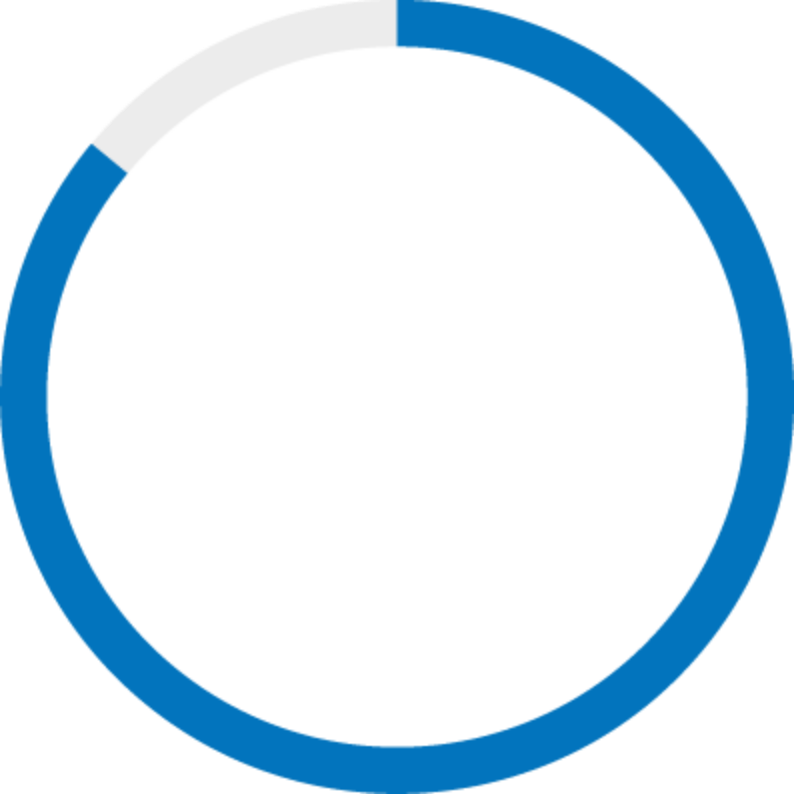

Of Cryptocurrency Investors Worry About Dying With Their Assets

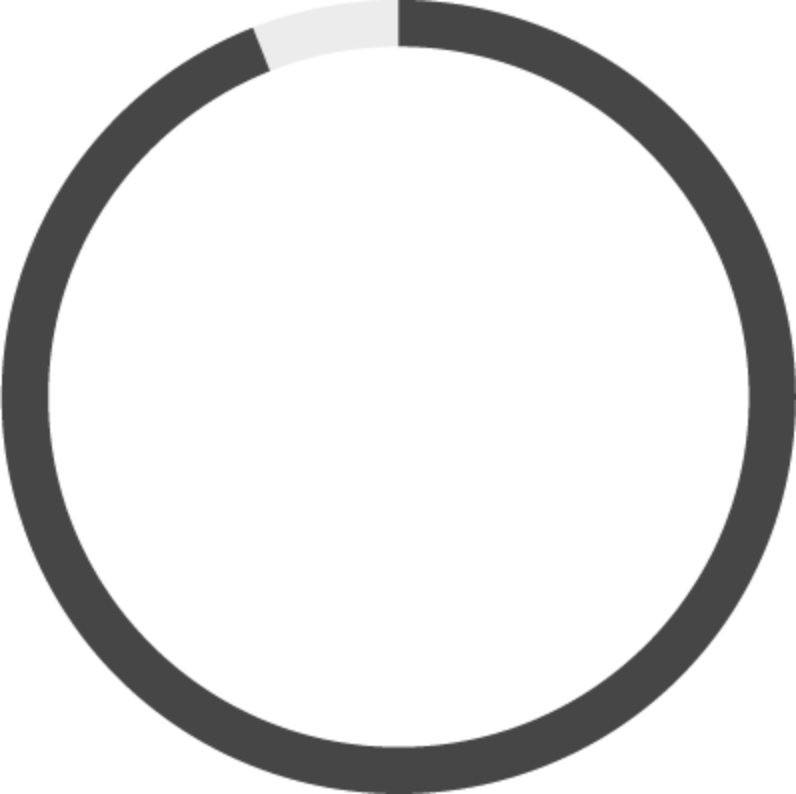

New Research conducted by The Cremation Institute reveals that 89% of cryptocurrency investors worry about what will happen to their assets after they die. Yet, despite this worry and real threat of losing their hard-earned crypto assets, only 23% of investors have a documented plan.

While complacency is a large factor, the combined issues of lacking crypto estate services and government regulation are important reasons for overall planning disorganization.

About The Study

Throughout the last decade, crypto asset investors have seen enormous growth. According to Coinmetrics.io, there are currently 12,000 Bitcoin millionaires in the world.

But with those 12,000 millionaires, there are also a tragic number of crypto investors who pass away each year, with their family unable to access their funds. According to Coincover, it is estimated that around 4 million Bitcoin (Approx 40 billion USD) has been forever lost due to death.

So, the question is: are most cryptocurrency investors failing to plan for what happens to their investments after they pass?

Who Is The Cremation Institute?

The Cremation Institute is a group of experts, contributors, and researchers who create important end-of-life resources for individuals and families to encourage thoughtful planning and to ensure security at all stages of life.

With the rising wealth and importance of cryptocurrency in the financial world, they regard the planning of crypto assets as an important end-of-life decision. As a result, they recently set out some important guidelines in their Crypto Estate Planning Guide to help crypto investors plan for the future.

+1 307 459 4975

Purpose Of The Study

The Cremation Institute set out to understand the metrics behind crypto investors who had a plan for what happens to their investment after they pass away, in addition to those who don't.

They also sought to understand the proportion of investors who plan, along with how they planned, and whether they were concerned about losing their assets.

What Are Crypto Assets?

Before going into the findings of the study, it's important to give a simple definition of what cryptocurrency is.

Key Findings

While 89% of crypto asset investors worry about losing their assets, only 23% of people have a plan.

10

TIMES

Younger generations are 10 times more likely not to have a plan in comparison to older generations.

4

TIMES

Cryptocurrency investors are more than 4 times less likely to use wills.

2

TIMES

Women are almost 2 times more likely to pass on their crypto assets.

Most Investors Worry About Dying With Their Crypto Assets

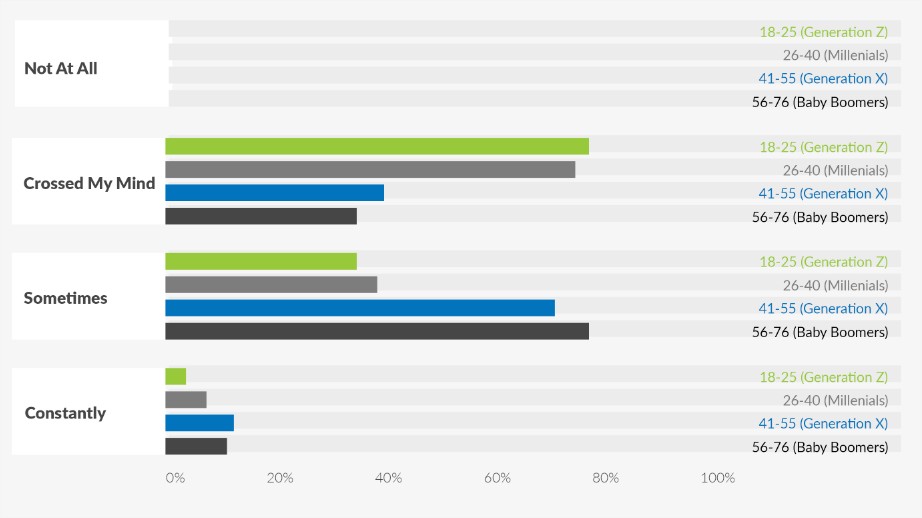

The findings overwhelmingly show that cryptocurrency investors have a real worry about their assets simply disappearing after they pass away. Overall, 89% of participants worry on some level about whether their crypto assets will be passed on to their loved ones.

Despite The Worry – Many Do Not Have A Plan

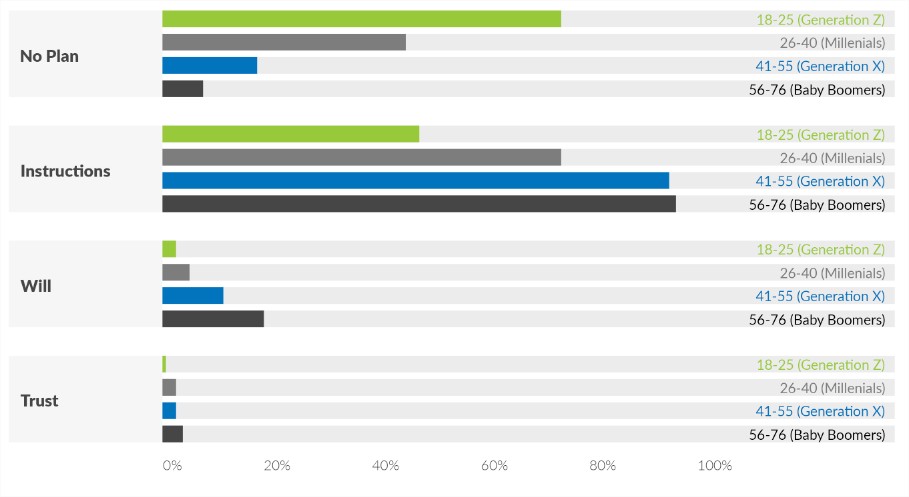

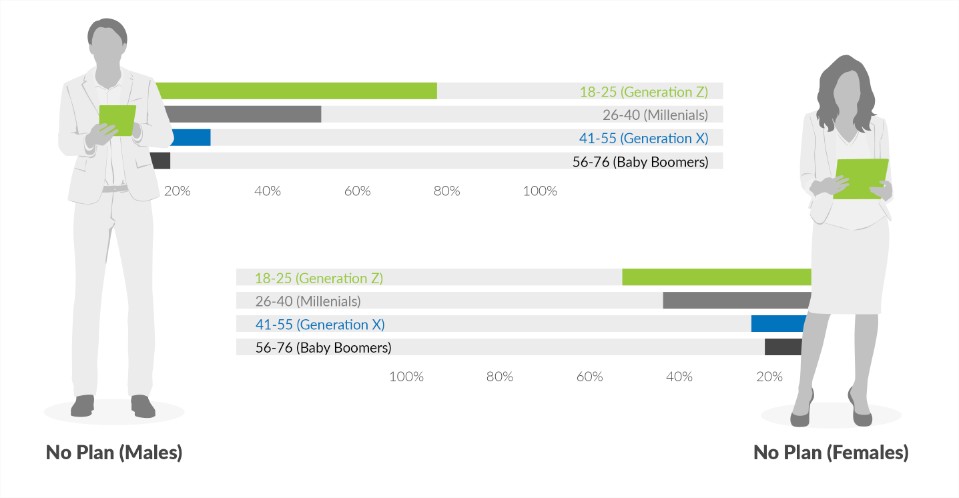

Despite this worry, many people have no plan in place. This is especially true for younger generations. The findings reveal that a concerning 59% of Generation Z crypto holders have no plan, while 35% of Millennials reported no plan.

Millennials Are 5 Times More Likely Not To Plan Than Baby Boomers

The results clearly show that older generations are more likely to consider future planning for their cryptocurrency assets. 86% of Generation X's and 94% of Baby Boomers impressively report having some sort of plan in place to ensure that their wealth is distributed amongst their family members.

CONSIDER FUTURE PLANNING

Generation X's

Baby Boomers

This is in contrast to the younger generations, who are much less likely to have a plan in place. Both Millennials (65%) & Generation Z (41%) reported having some sort of plan in place.

LESS LIKELY TO HAVE A PLAN IN PLACE

Both Millennials

Generation Z

Where People Store Instructions

In The Household

65%

Computer

17%

USB

15%

Safety Deposit

2%

Other

1%

As crypto assets holders generally plan through instructions, it is important to understand where and how people store them. In the same breath, it is important to define exactly what instructions are and what they should look like. These instructions were precise steps for another person (usually a next of kin) to access their funds if something should happen to them.

The findings show that 65% of people generally store them in their household for their spouse to access. Other popular areas include a computer (17%) and USB (15%).

And with those findings, another question and issue arose: safety and accessibility of these instructions.

Cryptocurrency Holders Are More Than 4 Times Less Likely To Use Wills

When analyzing the results, it was observed that cryptocurrency investors plan their inheritance very differently than average investors.

In order to compare planning behaviours of cryptocurrency holders with normal investors, The Cremation Institute analysed the Caring.com 2020 Estate Planning Study.

According to Caring.com, 32% of people claim to have a will in 2020. This is in contrast to 7% of crypto holders who include their digital assets in their will.

This disparity increases for younger generations. For example, 18% of people within the 18-34 bracket have a will, while only approximately 3% of crypto asset holders in this bracket document their plans in a will.

Women Are 39% More Likely To Pass On Their Assets

Results analysed by The Cremation Institute showed that women are significantly more likely than men to have some sort of cryptocurrency contingency plan if they were to pass away.

This was significant across all age groups except Baby Boomers, where males actually planned more than females.

The biggest difference was in the Generation Z segment where females planned 71% of the time, in comparison to their male counterparts that planned only 41% of the time.

AI Crypto Estate Services Will Exponentially Grow Over the Next 10 Years

The gap between the concern for not passing digital assets and taking the steps to plan ahead is actually quite alarming. However, part of the equation comes down to a lack of services and little legislation covering estate planning & crypto assets.

Matthew Burgoyne, attorney from McLeod Law, believes that “we will see an explosion in the number of AI-based third-party services, which manage private keys in the event of death. It is so critical that cryptocurrency is properly accessible to executors and heirs; this is a major issue”.

He also points out there are a number of unconventional solutions already available, one notably called “a dead man's switch.” This is an automated program designed to email the user at specific times, and wait for a reply. If the program doesn't receive a reply within a certain period of time, it will automatically check death certificate records of the user's passing.

If a user has died, the program will transfer the contents of his/her cryptocurrency wallets to a specific account (for example, the account of an executor), which had been set up and prepared beforehand.

There are a number of similar programs that rely on inactivity, and Burgoyne believes this will continue to grow exponentially over the next 10 years.

Conclusion

The study reveals that while most cryptocurrency holders worry about not passing their assets to their loved ones, most fail to plan appropriately. And in particular, younger generations. This lack of estate planning is coupled with a lack of cryptocurrency estate services and a lack of government regulation in some jurisdictions.

Methodology

The online survey was conducted between October 20, 2019- June 3,2020. In total, there were 1,150 participants between the ages 19-73. The margin of error for the total survey sample size is 3.5%.

For more information about our methodology, survey results, or anything else, please contact adam@cremationinstitute.com

Sources

https://coinmetrics.io/pubs/?tx_category=research

https://cremationinstitute.com/cryptoasset-inheritance-planning/

https://cremationinstitute.typeform.com/to/ZNU23k

https://www.forbes.com/sites/billybambrough/2019/11/26/bitcoin-isnt-dead-but-one-day-you-will-be

https://www.coincover.com/

https://www.investopedia.com/terms/c/cryptocurrency.asp

https://www.caring.com/caregivers/estate-planning/wills-survey

https://www.mcleod-law.com/